Quick Takes

- The Federal Open Market Committee (FOMC) reiterated that future rate increases will be appropriate, and Fed Chair Powell said that the ultimate level of rates will be higher than initially thought and that the notion of a pause any time soon was very premature.

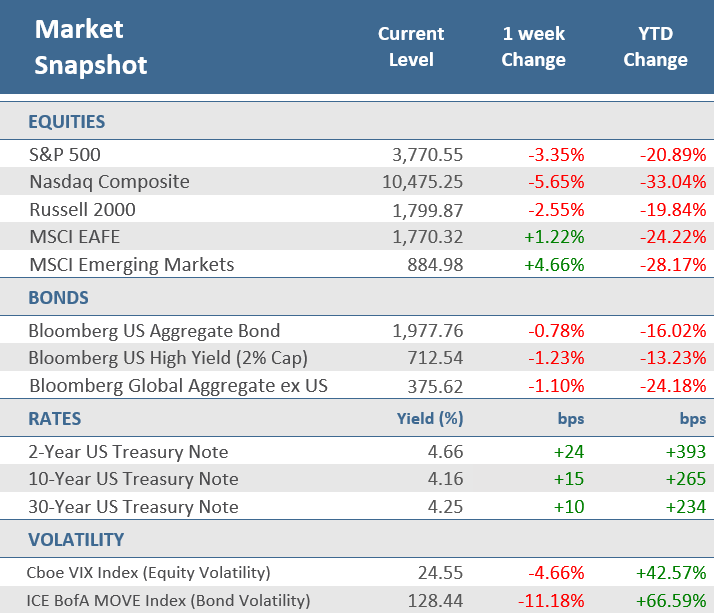

- Stocks snapped a two-week win streak as the S&P 500 lost -3.4%, the Russell 2000 (small caps) fell -2.6% and the Nasdaq sank -5.7%. However, developed markets international equities (MSCI EAFE Index) gained +1.2%, and MSCI Emerging Markets Index was up +4.7%.

- The still hawkish Fed put upward pressure on Treasury yields, with the 2-year Treasury yield up +24 bps and the 10-year yield up +15 bps. The Bloomberg Aggregate Bond Index fell -0.8% for the week, after its best weekly return since March 2020 the prior week (+1.7%).

U.S. stocks snap two-week win streak, bonds down too

U.S. stocks posted a weekly loss as Federal Reserve Chairman Jerome Powell’s comments after Wednesday’s fourth-straight 75 bps fed funds hike, in which he reiterated the Fed’s intent to cool the robust labor market, which remains resilient as evidenced by Friday’s larger-than-expected increase in nonfarm payrolls for October. The S&P 500 lost -3.4%, the Russell 2000 (small caps) fell -2.6%, and the Nasdaq sank -5.7%. Overseas though, stocks rebounded, with developed markets international equities (MSCI EAFE Index) up +1.2%, and MSCI Emerging Markets Index rallying +4.7% after being the only equity group in negative territory in October.

Wednesday’s Federal Open Market Committee (FOMC) statement noted that recent indicators have shown modest economic growth, robust job gains, and an unemployment rate that remains historically low. Still, inflation remains elevated, supply chain issues persist, as well as higher energy and food prices. The statement also mentioned that the continued war in Ukraine is creating additional upward pressure on inflation and weighing on economic activity globally. The FOMC reiterated that future rate increases will be appropriate, but it considers the impact of the cumulative monetary tightening that has already taken place on economic and financial developments. Shortly after the FOMC statement release, in his press conference Fed Chair Powell said that consumer spending has slowed, and housing activity has weakened because of the rise in interest rates, while also noting that the time to slow the pace of rate increases could come as soon as the December or February FOMC meetings. However, he also mentioned that the ultimate level of rates will be higher than initially thought and reiterated that the notion of a pause any time soon was very premature.

The hawkish Fed commentary and hotter-than-expected jobs data put upward pressure on Treasury yields, with the 2-year Treasury yield up +24 bps and the 10-year yield up +15 bps. The Bloomberg Aggregate Bond Index was down -0.8% for the week, after seeing its best weekly return since March 2020 the prior week (a gain of +1.7%).

Earnings surprises were mostly positive for the week, but overall, with about 85% of the constituents of the S&P 500 Index having reported, the third quarter earnings season has been lackluster so far with only 70% of S&P 500 companies posting better-than-expected earnings compared to 85% a year ago. Meanwhile, 24% of companies have missed EPS estimates versus 13% a year ago. Third-quarter profits are currently running at a +2.2% growth rate, which would mark the eighth consecutive quarter of year-over-year growth if it holds up. But after falling for several months, according to FactSet Research, Wall Street analysts forecast earnings growth rate for the fourth quarter has turned negative. Profits for Q4 are now projected to fall by -1%, far below the estimated growth of +9.1% back on June 30 and +3.9% as recently as September 30. On Oct. 28, Q4 profits were still estimated to expand, albeit at just a slight +0.2%. Companies will need to exceed analysts’ estimates over the next quarter to provide reliable support for a market rebound.

Chart of the Week

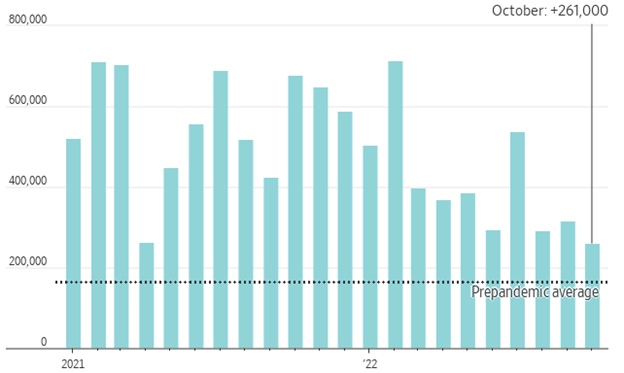

Job growth in October topped expectations, while the unemployment rate rose more than expected. As shown in the chart below, Nonfarm Payrolls grew by 261,000 jobs for the month of October, well above expectations for 193,000 new jobs. In addition, September’s results were revised upward to an increase of 315,000 versus the initially reported 263,000. Excluding government hiring and firing, Private Sector Payrolls rose by 233,000, also above expectations that were looking for a rise of 200,000, following the 319,000 new payrolls in September, revised up from the initially reported 288,000 gain. The Labor Force Participation Rate slipped a bit to 62.2% from September’s unrevised 62.3% figure, where it was expected to remain. The Unemployment Rate rose to 3.7% from September’s 3.5% rate, and above expectation for it to nudge up to 3.6%. Average Hourly Earnings were up +0.4% for the month, slightly higher than expectations of +0.3%, and matching September’s unadjusted rise. Compared to last year, wages were +4.7% higher, matching expectations, and below September’s unadjusted 5.0% rise. Finally, Average Weekly Hours remained at September’s 34.5 rate, in line with expectations.

October Job Growth Tops Forecasts

Nonfarm payrolls, month-over-month change

Note: The pre-pandemic average is the average monthly change in 2019. Data are seasonally adjusted.

Source: Labor Department, The Wall Street Journal.

Economic Review

- The October Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) fell to 50.2 from the prior month’s unrevised 50.9 reading—its lowest level since May 2020—but remained above the expansion level of 50, which is also what expectations were for it to be. The decline came as New Orders moved upward but remained in contraction territory, Production Growth nudged higher into expansion territory, and Employment inched higher. Additionally, Inventories grew at a slower pace, and Supplier Deliveries fell to their lowest level since 2009. Inflation pressures continued to ease, with the Prices Paid component dropping to 46.6 from 51.7.

- The October ISM Services PMI declined to 54.4, a larger-than-expected slowdown from the forecasts for 55.3, and well below September’s 56.7 reading. The index remained in expansion territory as shown by a reading above 50. New Orders and Business Activity both fell but both remained in expansion territory, while Employment dropped into contraction territory. Prices accelerated and remained elevated at 70.7. The ISM said, supplier deliveries continued to slow at a faster rate in October, while survey respondents said growth rates and business levels have cooled.

- The final October read on the S&P Global U.S. Manufacturing PMI unexpectedly rose into expansion territory (a reading above 50). The index went up to 50.4 from the preliminarily reported 49.9 figure, where forecasts called for it to remain.

- The final October read on the S&P Global U.S. Services PMI was revised to a less severe contraction level of 47.8 (a reading below 50) than the initially forecasted 46.6, which is where it was expected to remain. That is well below September’s 49.3 reading.

- The Labor Department’s Job Openings and Labor Turnover Survey (JOLTS) unexpectedly increase to 10.7 million jobs available to be filled in September, above expectations of 10.0 million, and August’s upwardly revised 10.3 million. The Hiring Rate was 4.0%, slightly below August’s 4.1%, and Total Separations—including quits, layoffs, discharges, and other separations—declined slightly to 3.7% from 3.9% in August. The Quit Rate for September remained at the prior month’s 2.7% pace.

- Preliminary Q3 Nonfarm Productivity grew by +0.3% on an annualized basis, under expectations of +0.5%, but far better than the unrevised +4.1% drop seen in Q2. Unit labor costs were up by +3.5%, below expectations of +4.0%, down sharply from Q2’s downwardly revised +8.9%.

- September Factory Orders rose +0.3% for the month, matching expectations, and above the prior month’s upwardly revised +0.2% gain. Durable Goods Orders—preliminarily reported last week—remained at the initially reported +0.4%, as expected. September’s final read on Nondefense Capital Goods Orders Excluding Aircraft—considered a proxy for Capital Spending—was revised up to a -0.4% month-over-month decrease from a -0.7% decline in the preliminary reading.

- Construction Spending rose +0.2% for the month of September, far better than expectations of -0.5% and August’s upwardly revised -0.6% drop. Residential spending increased +0.2% for the month, while non-residential spending was unchanged.

- The October Dallas Fed Manufacturing Index unexpectedly fell further into contraction territory—a reading below zero—dropping to -19.4 from -17.2 in September, far worse than expectations for an improvement to -16.8. New Orders contracted further, while growth in Production moderated and Shipments turned negative. Employment increased slightly and remained comfortably in expansion territory, and Inflation pressures were mixed and remained severely elevated, with Prices Paid moderating, but Prices Received rising.

- The October Chicago PMI declined further into contraction territory (a reading below 50), falling to 45.2 from 45.7 in September—the lowest since June 2020—well below expectations for a slight rise to 47.7.

- The weekly MBA Mortgage Application Index fell -0.5% from the prior week’s -1.7% decline. It was the sixth straight weekly decline as the Refinance Index was up +0.2% from last week but the Purchase Index was down -0.8% for the week. The decrease came even as the average 30-year mortgage rate declined for the first time in 11 weeks, decreasing 10 bps to 7.06%—coming off a two-decade high—but is up 3.82 percentage points versus a year ago.

- Weekly Initial Jobless Claims were 217,000 for the week ended October 29, under expectations for 220,000, and the prior week’s upwardly revised 218,000. Continuing Claims for the week ended October 22 rose by 47,000 to 1,485,000, higher than expectations of 1,450,000.

The Week Ahead

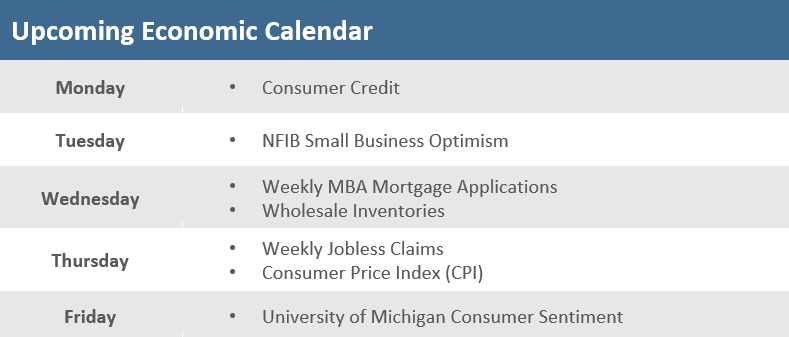

The economic calendar is light for the upcoming week but includes the key October Consumer Price Index (CPI) on Thursday, which is expected to show that inflation remains hot. But the midterm elections on November 8 will likely be the week’s big focus. The stock market typically rallies in the final months of midterm election years and may heavily influence how markets trade the rest of the year. The consensus expects divided government between the White House and Congress as Republicans most likely will take control of the House of Representatives, and possibly the Senate. Historically the stock market has outperformed with a dividend government over the returns generated in the years following the same party controlling the Senate, the House, and the Presidency. Companies will also continue to report third-quarter earnings during the week, with Disney, Wendy’s, and Occident Petroleum among those reporting results.

Did You Know?

REFIS RUNNING LOW – The number of U.S. homeowners who can save money by refinancing at today’s mortgage rates has fallen to just 133,000, down from a peak of over 19 million in late 2020. The Federal Reserve’s efforts to fight inflation have sent mortgage rates soaring above 7% and refinancing no longer makes sense for many homeowners (source: Black Knight, The Wall Street Journal).

TECHNOLOGY TRIUMPHS – Market automation, including automated trading, has reduced trading costs for investors by 50% over the past 10 years and resulted in 30% more savings in Americans’ retirement accounts over their lifetimes. Without market automation, an investor earning $70,000 a year would have to work 2½ years longer to reach the same retirement savings goal (source: Modern Markets Initiative, MFS).

(NOT BEING) MADE IN CHINA – China’s official gauges measuring factory, construction, and service activities tumbled into contraction territory in October, signaling fresh signs of weakness in the world’s second-largest economy. The official manufacturing purchasing managers index (PMI) fell to 49.2 in October, compared with 50.1 in September. Levels above 50 denote economic expansion, and below 50 is economic contraction. China’s official nonmanufacturing PMI, which covers service and construction activity, fell to 48.7 in October, down from 50.6 in September, dragged down by the slumping service sector and slower growth in construction activity (source: China National Bureau of Statistics, The Wall Street Journal).

This Week in History

ELECTION BROADCASTING BEGINS – On November 2, 1920, the first widespread commercial radio broadcast hit the air as station KDKA in Pittsburgh sent out bulletins on the Presidential election to an audience of hundreds of ham radio operators. The broadcast was made by Leo Rosenberg, speaking through a retooled telephone mouthpiece from a wooden shack on the roof of a Westinghouse factory. His first words were, “We shall now broadcast the election returns.” (source: The Wall Street Journal).

Asset Class Performance

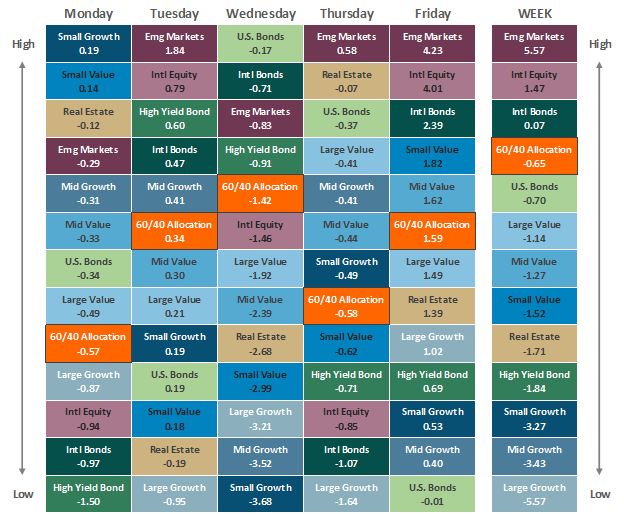

The Importance of Diversification. Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg.

Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

* The term basis points (bps) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 0.01%. Bond prices and bond yields are inversely related. As the price of a bond goes up, the yield decreases.