![[Blog Post] - Russia Invades (Again) | The Retirement Planning Group [Blog Post] - Russia Invades (Again) | The Retirement Planning Group](https://www.planningretirements.com/wp-content/uploads/2022/02/Russia-Invades-Again.jpg)

On December 27, 1979, millions of Americans grabbed their morning coffee, walked outside to get the paper, opened it up and saw this headline:

This was the beginning of the Soviet invasion of Afghanistan. The world condemned it. There was conjecture that this was the beginning of a larger global move on behalf of the Soviets. It created turmoil, unrest and anxiety. Sound familiar? Ultimately, the Soviets left in 1986 and as we know the USSR collapsed in 1991.

History does indeed repeat itself. We aren’t going to downplay the severity of this – particularly to the people of the Ukraine. But we think it is important to frame what this is really about. The Russia/Ukraine event has very little to do with “democracy.” It has to do with energy, which is the lifeblood to Russia. Russia supplies 40% of Europe’s heating fuel, in the form of natural gas. One of the two aging pipelines through which the gas is transmitted runs through Ukraine, which had lately broadcast a yearning for increased ties to the West. Putin could never allow this.

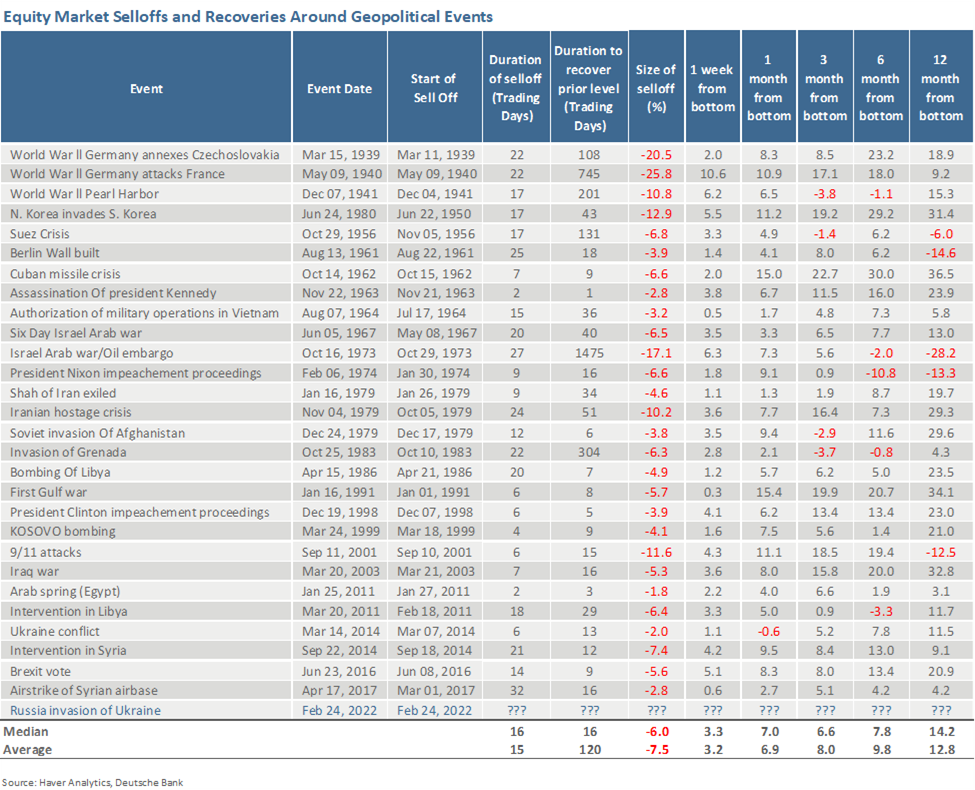

In times like these, context is also very important. So we wanted to supply you with many other global events and the outcome on financial markets. Take a peek:

Most of our clients have lived through 90% of these events. Markets reacted and recovered.

History has consistently shown that investors benefit from staying invested, even during uncertain and frightening crisis events. Today investors’ fears are running high as global stock markets drop amid news of the Russian invasion of Ukraine. Yet, the stock market and economic experiences over the past several decades were at times quite frightening too. The U.S. economy, as well as the stock market, has been extraordinarily resilient and has routinely recovered from short-term crisis events to move higher over the long-term. The table above demonstrates that while the stock market, on average, declined during periods of crisis, often sharply, the subsequent 3-, 6-, and 12-months periods have historically been higher. Over the 12-month ensuing periods, on average, the market has averaged double-digit returns.

The oil embargo of 1973, Vietnam, 2 Gulf wars, 9/11, Brexit…etc…have all been baked into the long-term averages we use to craft financial plans for clients. And this will be another unfortunate line item in the history of unfortunate line items that the U.S. economy and markets will navigate and recover from.

We know that many of you are weathered market veterans and know these things. However, we also know that it can produce some unwanted anxiety and sleepless nights for those who are newly retired or less experienced with these market drops.

That is why we’re here. Don’t hesitate to reach out to us with questions or concerns!