November Performance Summary

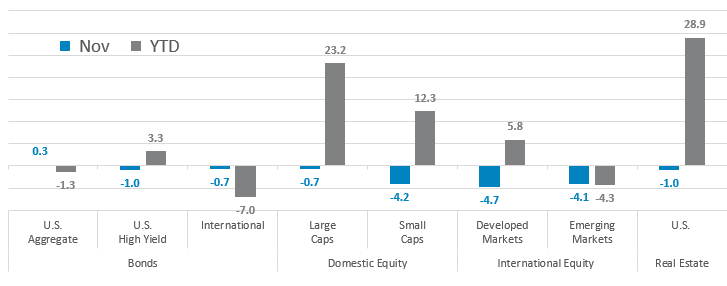

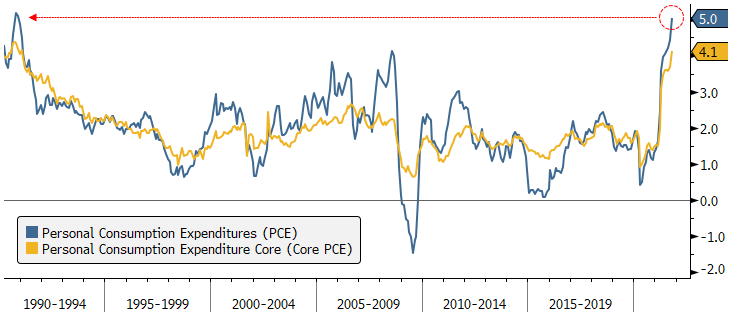

Well, November didn’t quite live up to its reputation. Historically, November has been the second-best month of the year for stocks, but not this November in which the S&P 500 Index actually declined a bit, dropping -.07% on a total return basis. In fact, with the exception of U.S. bonds–which managed to eke out a 0.3% gain–, all major asset classes lost ground in November. Still, the S&P 500 was just -2.9% from its all-time high set on November 23. Small caps had a rougher month though, with the Russell 2000 Index losing -4.2%, which was -10.0% from its all-time high set on November 8. International equities were the worst-performing group of the major asset classes, as the MSCI EAFE Index fell -4.7%. It set a record high on September 6 but hasn’t been able to recapture that and sat -7.5% below that all-time high at the end of the month. The down month likely feels worse than it was because the last three days of the month swung back-and-forth wildly. The S&P 500 was up or down more than 1% each day of the last three days (down -2.3% on the 26th, up +1.3% on the 29th, and down -1.9% on the 30th) after not having a single 1% move in the prior 29 trading days. The markets were already jittery with inflation concerns going into the Thanksgiving Daybreak, but news of the omicron COVID variant took over investors’ emotions those last few days and spurred the sell-offs.

Source: Bloomberg, as of November 30, 2021. Performance figures are index total returns: U.S. Bonds (Barclays U.S. Aggregate Bond TR), U.S. High Yield (Barclays U.S. HY 2% Issuer-Capped TR), International Bonds (Barclays Global Aggregate ex USD TR), Large Caps (S&P 500 TR), Small Caps (Russell 2000 TR), Developed Markets (MSCI EAFE NR USD), Emerging Markets (MSCI EM NR USD), Real Estate (FTSE NAREIT All Equity REITS TR).

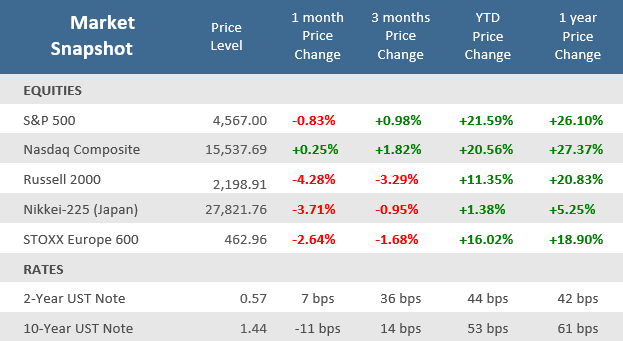

For fixed income, most of the focus was on flattening the yield curve. For the second month, the yields of short-term bonds advanced more relative to the yields on long-term bonds, i.e., a flattening of the yield curve, which may be signaling the market is expecting slower economic growth or perhaps a Federal Reserve policy mistake. In November, the 10-year U.S. Treasury note yield fell 11 basis points (-0.11%) while the yield on the 2-year U.S. Treasury increased seven basis points (+0.7%). Most of the decline in the 10-year Treasury yield came on the Friday after Thanksgiving when the 10-year UST yield fell to 1.48% from 1.64% on Wednesday before Thanksgiving—the most significant one-day yield decline since the pandemic and a clear reflection of the threat of the omicron variant and the more hawkish tone by Fed chair Powell that bond tapering may be accelerated (and therefore rate increases may be pulled forward in 2022).

Source: Bloomberg.

Quick Takes

Flattened

The gap between yields on 5-year and 30-year U.S. Treasurys is the narrowest it’s been since March 2020 at the depths of the pandemic. More Federal Reserve officials have joined Fed Chairman Jerome Powell in the chorus for monetary policy tightening, signaling that to stem inflation pressures they’re willing to accelerate the wind-down of the Fed’s bond-buying and raise interest rates in 2022. This has resulted in the interest rates of short-term and intermediate-term maturity Treasurys jumping higher (two-, five- and seven-year yields), while rates for longer-term Treasurys rose less. The yield premium of the 30-year bond over short-term, and more policy sensitive, five-year note have fallen under 60 basis points, the most compressed level since March 2020.

Treasury Yield Curve Flattens

Treasury curve compresses to level last seen in March 2020

Source: Bloomberg.

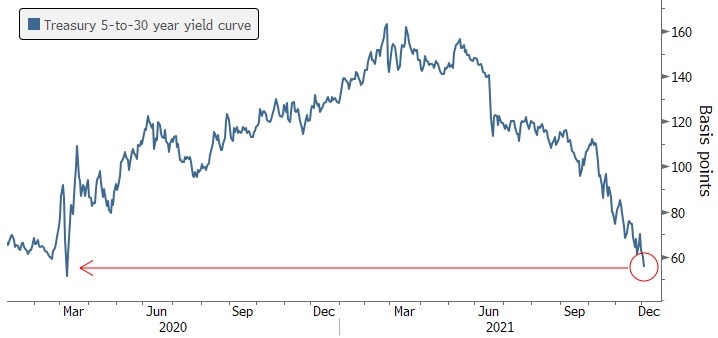

Inflation is here

The PCE Price Index rose 5.0% over the last year, the highest US inflation rate in 31 years. Prices for Personal Consumption Expenditures excluding food and energy, or Core PCE, increased +4.1% from a year ago, its highest rate of growth since January 1991. The upward revisions for the past month suggest inflation is running hotter than realized. Bloomberg economists expect inflation to further accelerate into early next year. Household spending is also surprisingly robust. The combination of higher inflation risks and consumer resiliency means that the likelihood of the Fed accelerating the pace of taper has increased.

Consumption Expenditures are the highest in 30 years

PCE Inflation (year-over-year % change)

Source: Bloomberg.

Home Prices at All-Time Highs

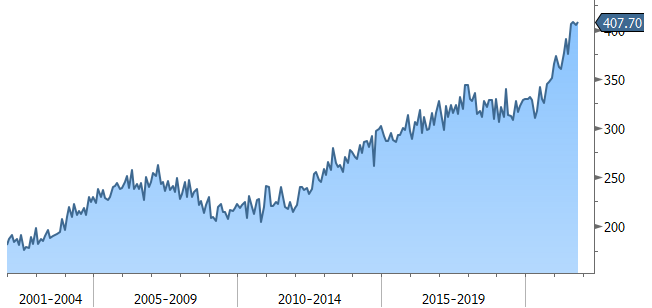

Speaking of inflation, the median sales price of a new home in the U.S. jumped +18% from a year earlier to a record $407,700. New home sales increased even as prices climbed to the record highs, helped in part by low mortgage rates – 30-year fixed mortgage rates are 3.1%, near historic lows. There were 389,000 new homes for sale as of the end of October, the most in 13 years — though 28% of those houses were not yet started. At the current sales pace, it would take 6.3 months to exhaust the supply of new homes, compared with 3.6 months at the start of the year.

U.S. New Home Sales, Median Price ($)

Monthly (2000 – 2021)

Source: Bloomberg.

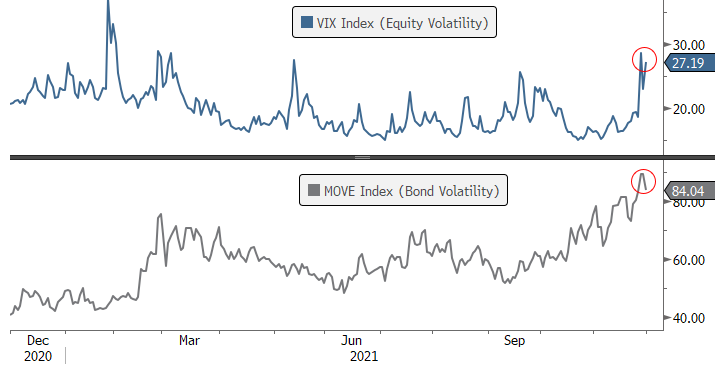

Volatility Jumps.

Volatility is rearing its head, but it’s not just in the equity market. With the Fed hinting at potentially accelerating tapering and rate increases as inflation pressures persist, the bond market is also at elevated levels of volatility. Throw in the new omicron COVID variant and geopolitical risks, particularly heightened U.S.-China tensions, and it’s likely that both equity and bond volatility have the potential to stick around. Still the equity and bond volatility indices are far below the levels reached during the pandemic. The VIX equity volatility index is currently hovering around 30 but had spiked over 80 in the pandemic and was also in the high 20’s range at points in January, March, May and September of this year. However, the MOVE bond volatility index has topped 80 for just the first time since March of 2020 which reflects the growing uncertainty of Fed policy in 2022. That is still well below the 160 level reached at the apex of the COVID pandemic in early March 2020.

Source: Bloomberg.

Playing the odds

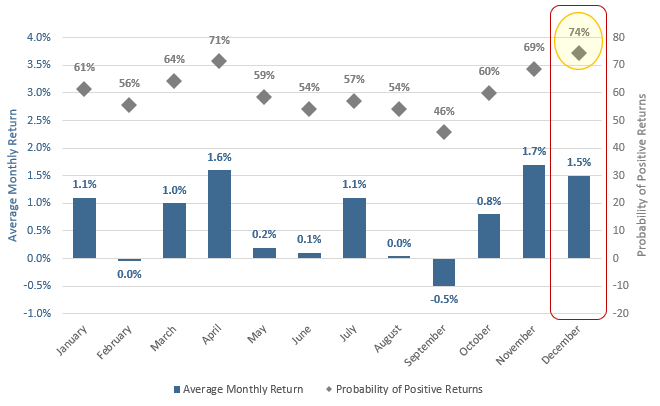

According to data from LPL Research covering the period from 1950 to 2020, the S&P 500 was up +1.5% on average during the month of December. Historically, that’s the third-best average monthly return of the year. But there’s more good news, at least from a historical seasonality perspective. The month of December has been positive 74% of the time, more than any other month of the year.

December Is Positive More Frequently Than Any Other Month

S&P 500 Index average monthly return and probability of positive returns (1950-2020)

Source: FactSet, LPL Research.

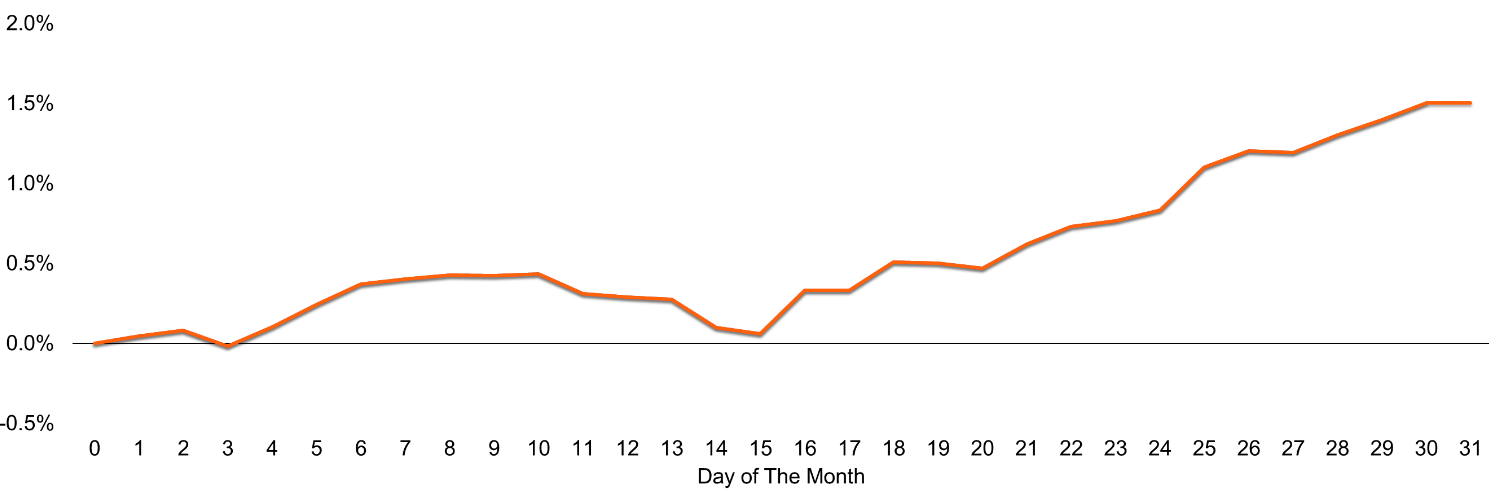

Santa rallies tend to show up mid-month

As discussed, November was a rocky month, particularly in the final week. Looking at the historical patterns for the month of December, it tends to be relatively mild until the back half of the month when the fabled seasonal “Santa Rally” gets underway. As seen in the chart below, the first half of December has tended to be range bound, but right about the midpoint of December has seasonally started a steady, consistent uptrend into the new year. Of course, November didn’t follow the average seasonal pattern (for being the best month of the year) so perhaps there is some additional capacity for a Santa rally this December?

Santa Tends to Show Up in the Second Half of December

S&P 500 Index Average Returns in December (1950-2020)

Source: FactSet, LPL Research.

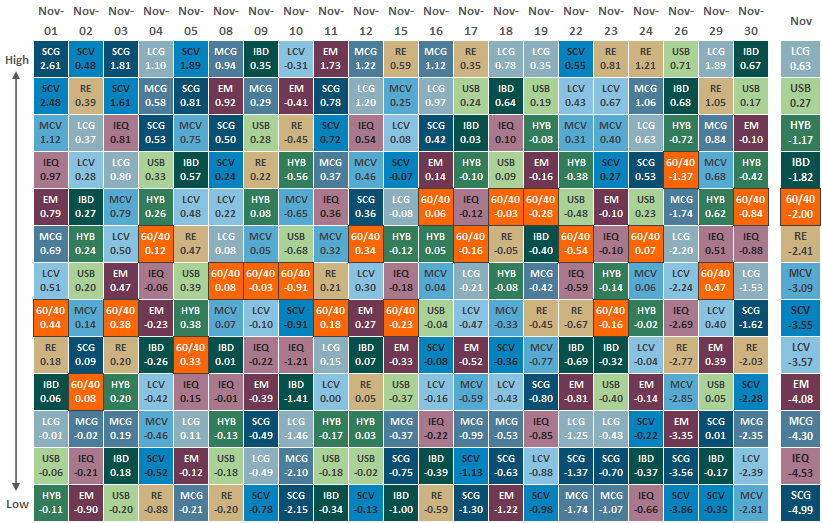

Asset Class Performance

The Importance of Diversification

Diversification mitigates the risk of relying on any single investment and offers a host of long-term benefits, such as lowering portfolio volatility, improving risk-adjusted returns, and helping investments to compound more effectively.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by The Retirement Planning Group. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Chris Bouffard is CIO of The Retirement Planning Group (TRPG), a Registered Investment Adviser. He has oversight of investments for the advisory services offered through TRPG.

Disclaimer: Information provided is for educational purposes only and does not constitute investment, legal or tax advice. All examples are hypothetical and for illustrative purposes only. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed. Please contact TRPG for more complete information based on your personal circumstances and to obtain personal individual investment advice.