Charles Schwab Review

Working with a Schwab Advisor or thinking about it?

Curious about Charles Schwab reviews?

There are some things you definitely should know.

6 Things You Should Know

If you are working with or thinking about working with, a Schwab Advisor or looking into Charles Schwab reviews:

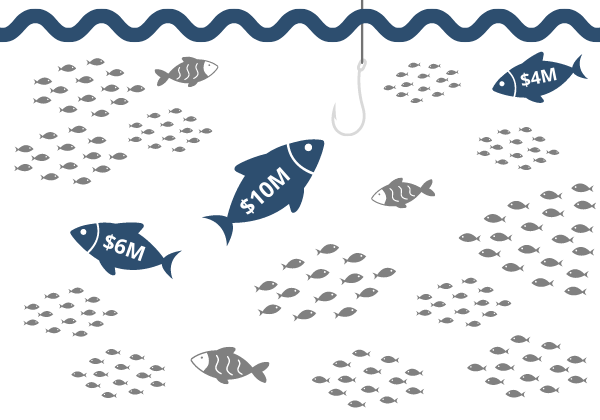

Small Fish - Big Pond:

Your advisor may have over 500+ clients to keep tabs on. You can do the math – there are 2000 working hours a year – if your advisor has 500 clients, your entire financial welfare hinges on the hope that you are getting 4 hours of your advisor’s time. Unless you have 10s of millions of dollars, you are a small fish.

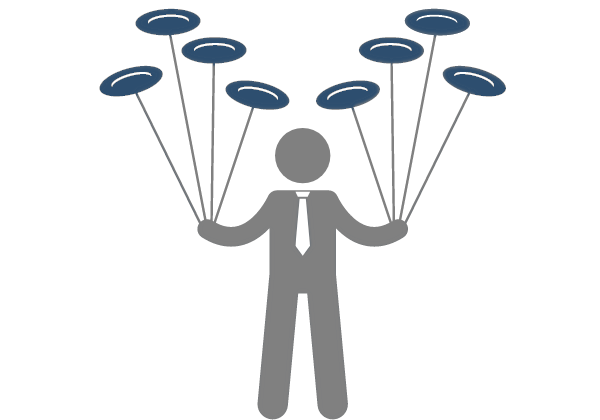

Spinning Plates:

Your Schwab Advisor is typically undersupported. They have one assistant across the branch. Even the busiest senior advisors with more than $1B in client assets have to share an assistant. They are spinning 20 plates and their main support is to refer you to the 800 number to handle things yourself. Instead of focusing on your really important financial issues, they are trying to find their next client.

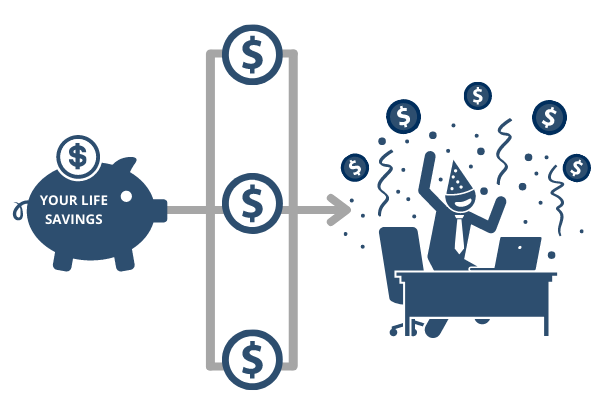

Flavor of the Day:

Your Schwab Advisor gets different levels of compensation payouts based on what product they sell to you. Schwab routinely adjusts those compensation plans to drive more investor dollars into certain products. When that happens, your advisor will likely steer you in a different direction – oftentimes based on increasing their compensation – not what is really best for you.

Watered-Down Planning:

They use a presentation system called MoneyGuide Pro (MGP) – but it’s been stripped down to its bare bones and lacks critical capabilities. Your Schwab Advisor received minimal training on MGP. It might look like you are getting a Ferrari, but under the hood is a gerbil and a wheel.

Designations Without Clout:

You might be working with a CFP® professional. But go ahead and ask them for a simple 401k allocation. Their hands are tied about what kind of advice they can offer. They aren’t allowed to provide that. Schwab doesn’t want that liability. Your advice is capped – and so are the solutions.

Limited Options:

You will likely be talked into one of four limited investment solutions. SIP, SPC (Schwab Private Client), SAN, or Windhaven Managed Portfolios. Your problems likely need limitless solutions. You likely need more comprehensive help.

How do we know all of this?

For over a decade, we were one of about 200 firms across the Nation that Schwab referred business to. You see, when things are too complex for an advisor at Schwab, they turned to us. We mutually left this referral arrangement for a number of reasons – but mainly because an advisor at the Schwab branch is more of a salesman with a bag of products and production quotas to hit. That didn’t feel right to us. And likely doesn’t feel right to you.

Charles Schwab Reviews – Services

Charles Schwab Intelligent Portfolios Reviews

For those looking for a more hands off approach using a robo advisor, the Charles Schwab Intelligent portfolio may sound familiar. Robo advisors are becoming more popular. They can be an option if you are looking to invest but don’t have a lot of money to get started. While they are suitable for those starting out, they often lack the comprehensive planning many need to save appropriately for retirement. Those looking at Charles Schwab reviews may be looking into an Intelligent Portfolio.

What is the Charles Schwab Intelligent Portfolio? It is essentially a low cost, starter portfolio administered by Charles Schwab. Answer a few questions, and the Charles Schwab system presents a recommended allocation of their preset options. For example, if you want to be more conservative the recommendations would shift more to bonds and other conservative investments. One downside is that the portfolio is limited to the few options available across stocks, bonds, mutual funds and always has a portion of the portfolio allocated to cash, which generates minimal if any returns.

For investors who have a minimum of $5,000 to invest and looking for a hands-off option to manage their investments, the Intelligent Portfolio could be one option. However, for anyone looking at an Intelligent Portfolio review, you may be looking for a more complete and comprehensive resource for your financial planning needs. The Intelligent Portfolio is a way to get started but may not provide enough support for your entire retirement planning picture or help you choose the best investments.

While the Intelligent Portfolio can be a jumping-off point in your financial planning, the low-cost commitment may hurt your long-term returns or have some thinking they are thoroughly planned for retirement when they have not even scratched the surface.

Charles Schwab Roth IRA Review

A Roth IRA is a standard tax-advantaged retirement savings option offered by many brokerages. A Roth IRA allows you as the investor to save money for retirement, tax-deferred. What does this mean? It means you invest money you already paid taxes on, allow this money to grow through investments in your Roth IRA account, and when you take this money out you pay no additional taxes.

How is Charles Schwab’s Roth IRA? It functions like many other brokerages out there. The IRA account allows you to choose from a range of options for investing your money. If you are looking for particular investment options, it is best to research up front to determine if the brokerage has these available. For more particular investors, it is even better to work with a retirement planning professional, or an independent registered investment advisor (RIA) firm like The Retirement Planning Group to choose the right options.

A review of Charles Schwab’s Roth IRA is difficult to complete without evaluating your investment needs and retirement plans.

Charles Schwab Review – Brokerage Account Review

Similar to the above for the Charles Schwab Roth IRA review, completing a Charles Schwab brokerage account review, is difficult without knowing the specifics for an investor. A brokerage account can often mean an account that is outside of the normal retirement plan options like an IRA, 401k, 403b and can incur taxes if not planned for properly.

However, fees are one area that can be easy to compare. For Charles Schwab, there are minimal fees for common transactions such as stock trades or ETFs, which is very similar to many brokerages . Many do charge a mutual fund fee, which may be waived if the brokerage owns the mutual fund (like Fidelity).

A brokerage account can mean a tax bill at the end of the year if not managed and planned for if it is outside a tax advantaged retirement account like an IRA, 401k, 403b, or other similar account. If you are looking into expanding your investment options, consider working with a wealth manager who can identify your needs, consider how to plan for tax time, and make recommendations based on your income and goals.

A wealth manager works with individuals with more money at their disposal. Beyond just planning your brokerage account, they can also help avoid mistakes and make sure you are maximizing all your options so your money works for you.

Our Take

Working with Charles Schwab can be an option for some people. You have to decide the approach you want for your complete financial picture, which is why people like you are looking at Charles Schwab reviews. At The Retirement Planning Group, we pride ourselves on being an independent registered investment advisory firm.

It is no hassle if you are already with Charles Schwab and want to work with us. Your accounts stay there. Our team of professionals will work with you to plan your financial needs now and as they change and then create the right investment mix to get you there.

You’ll also receive additional support you may not have at Charles Schwab: like estate planning, custom investment options and support, and a huge benefit that we will do your taxes. (score!)

Ready to see what working with a truly comprehensive, and independent, firm can do for you? Contact us today for a free 10 min consultation. We’ll see if we can fit well together, and there is no obligation. Get started today!

We value your privacy. 🔒